Investing in gold

Remember when a chocolate bar cost a quarter?

When you could fill your car up for 5 dollars?

Whatever happened to those days?

Paper currency lives and dies by the responsible nature of the government. If they over-print, the paper becomes valueless. They call it inflation, and that’s why a dollar saved today is worth less tomorrow. That’s why a chocolate bar no longer cost a quarter.

Do you feel comfortable with politicians and the government acting responsibly, not trading their own short-term interests for the long-term stability of the United States economy and your future?

Meet Uncle Sam.

He’s got a lot of bills to pay. Almost four trillion dollars worth every year.

But Uncle Sam’s income is only a little over two trillion dollars per year — so to make up for the difference he does what most Americans do - He borrows money. When Uncle takes out a loan he calls it a bond. Bonds can be held by banks, investors or even foreign governments — And just like when you and I take out a loan, Uncle Sam has to promise to pay interest on these bonds.

Let’s pause there for a second.

Imagine paying for your mortgage with your credit card. That’s exactly what Uncle Sam does. He takes out new loans so that he can make payments on the old ones. All those loans, and especially all that interest, adds up.

And Right Now Uncle Sam Owes 17 Trillion Dollars

That’s our national debt. Let’s put that insane number in perspective: It’s about the same as the national GDP. That’s the total value of all goods and services produced by the American economy in a year.

Huge amount of money, right? Uncle Sam is actually running out of people to borrow from. He’s even having trouble paying the interest on his loans. That’s some serious trouble.

But he’s Uncle Sam — so he solves the problem by calling in a favor.

He calls up his good old buddy “The Federal Reserve” and The Federal Reserve helps out by printing new money. Problem solved. Check it out:

The problem is that the more of something there is, the less it’s worth.

Same goes for the U.S. dollar. The more dollars there are, the less each one will buy.That’s why commodities like gold become more expensive when Uncle Sam prints new money. The commodities aren’t really worth more — your money is simply worth less.

And that’s inflation.

But why is this a problem? And what does it have to do with gold? Remember the foreign governments that lent money to Uncle Sam?

Since 1971 the United States has been running trade deficits with the rest of the world. Meaning we’ve been buying a lot more products from the rest of the world than they have been buying from us.

The Japanese and Korean sell us cars and electronics. The middle east sells us oil, And the Chinese sells us everything on our Walmart shelves. The United States pays for these products with US dollars.

And everyone is happy.

But, if countries where to convert these US dollar profits back into their own currencies their currencies would rise in value— Making their economies less desirable to trade with.

Instead, countries invest their dollar profits by buying US government bonds. So countries around the world sell their goods to the United States in exchange for US dollars. which have been borrowed through the federal reserve in exchange for government bonds. The countries then loan their profits back to the United States by buying more government bonds.

The money from these loans are spent on government expenses, as well as paying back previous government bonds. But in order to to this…

…Larger and larger loans must be made to pay back the principle and the interest.

Sounds complicated? That’s because it is. We’re using metaphors and storytelling to simplify, but here’s basically what this means for you:

In order for the US government to function we need to borrow more and more money from the rest of the world. And the more money they loan us today, the more money they’ll have to loan us in the future (because of interest). And if they ever stop loaning the whole thing collapses and we can’t pay them back.

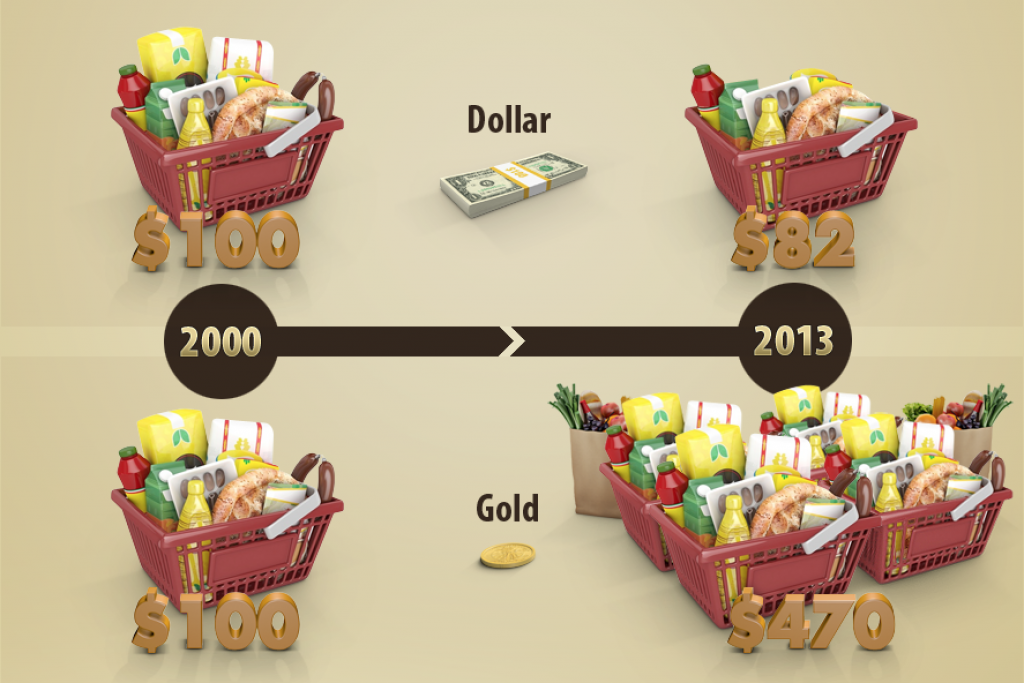

And the more money we print, the less purchasing power it will have:

See the correlation between how much a dollar is worth VS how munch money there is? What that means for you is that a dollar saved today is worth less tomorrow.

Your hard-earned dollar will simply buy you less if more money is in circulation.

Here’s an example:

$100,000 saved today with a 3% annual inflation rate will be worth around $47,000 in 25 years from now. Here’s another way to look at it: A $100,000 BMW will cost $209,377 in 25 years from now assuming a 3% annual inflation rate. So in order for you to afford a brand new BMW in 25 years from now you’ll need to put $209,377 in the bank today and not touch it for 25 years (like your retirement savings, basically.).

But what about interest rates? If you get a 5% annual return on your $100,000 you’ll have $338,635 in 25 years from now. (That’s assuming there’s no financial crisis or stock market crash). But here’s the thing: Because of inflation your $338,635 will no longer buy you 3 brand new BMWs — It will buy you one and a half.

And what if Uncle Sam and his buddy The Federal Reserve decides to print even more money? Inflation goes up – your savings are worth even less.

$1,000,000 in savings could be worth $80,000.

What are you going to do then?

The takeaway here is threefold:

1) there’s too much at stake,

2) you’re not in control, and

3) your retirement savings will disappear if the economy collapses, there’s another financial crisis or inflation rates goes up.

What you need to do is plan ahead.

So why is gold different?

If you uncovered a 5,000 year old Egyptian tomb — what do you think you’ll find inside it? It would be filled with gold. Not paper currency. This is because gold has worked as a reliable monetary system from the Ancient Egypt, to Rome, and even up to 1971 in the United States. And here’s the difference VS any paper currency:

In Ancient Rome, an ounce of gold would buy you a suit of armor.

In United States in 1910 it would buy you a gentleman’s suit.

And in 2014 an ounce of gold would still buy you a tailor-made designers suit.

Not much has changed for thousands of years, has it?

Here’s another example:

An ounce of gold in 1910 represented about $20 – and a 100 years ago you could buy 200 loafs of bread with $20. Simply put: An ounce of gold would buy you 200 loafs of bread. Fast-forward 100 years and today you’ll get 6 loafs of bread for the same $20. But how many loafs of bread would you be able to buy with an ounce of gold? 575! That’s because gold has not only withheld its purchasing power but also increased in value.

Up until 1971, all U.S. dollars printed were required to be backed by gold in federal vaults, but in 1971, President Nixon abandoned the gold standard, giving the government the ability to effectively print money at will.

Since then, the united states debt has gone from $414 billion to $14 trillion, a 3,381% increase.

And at the same time, the U.S. dollar has lost 97% of its value.

if you put $10,000 in gold in 2002- roughly 10 years ago – it would be worth $63,000 today. That’s a 600% return on your investment. Governments, billionaire investors and some of the largest institutions in the world are buying gold, including Goldman Sachs, JP Morgan and Morgan Stanley – to hedge against future financial crisis, inflation, unforeseen risks — but also because they believe that its value will rise.

Why wouldn’t they? Gold is great at the time of major disasters. 1970s wars and oil crisis? No problem. Dot com crash? No problem. 2008 crisis? No problem. What about the next crisis or crash? When your stock investments tank, gold will go up.

Just like your best friends, gold’s real worth is seen at the time of a crisis.

There’s a reason why every paper currency in history has eventually been rendered worthless. Sure – it’s true that gold just sits there and looks pretty, but when it comes down to it, that’s pretty much what you want from your currency.

Here’s what to read next:

Why Invest In Gold? Continued

How A Physical Gold IRA Can Protect Your Wealth

How To Convert a 401(K) to Gold

Top 10 Gold IRA Companies